RETIREMENT

The NALC has a Retirement Department that serves the members, active and retired, with advice and assistance regarding pre-retirement and post-retirement issues. These issues primarily involve the Office of Personnel Management (OPM) and its administration of the Civil Service Retirement System (CSRS) and the Federal Employees’ Retirement System (FERS). But the issues also at times intersect with other agencies and programs, including the Thrift Savings Plan (TSP), Medicare, Social Security, Federal Employees’ Group Life Insurance (FEGLI) and Federal Employees’ Health Benefits (FEHB).

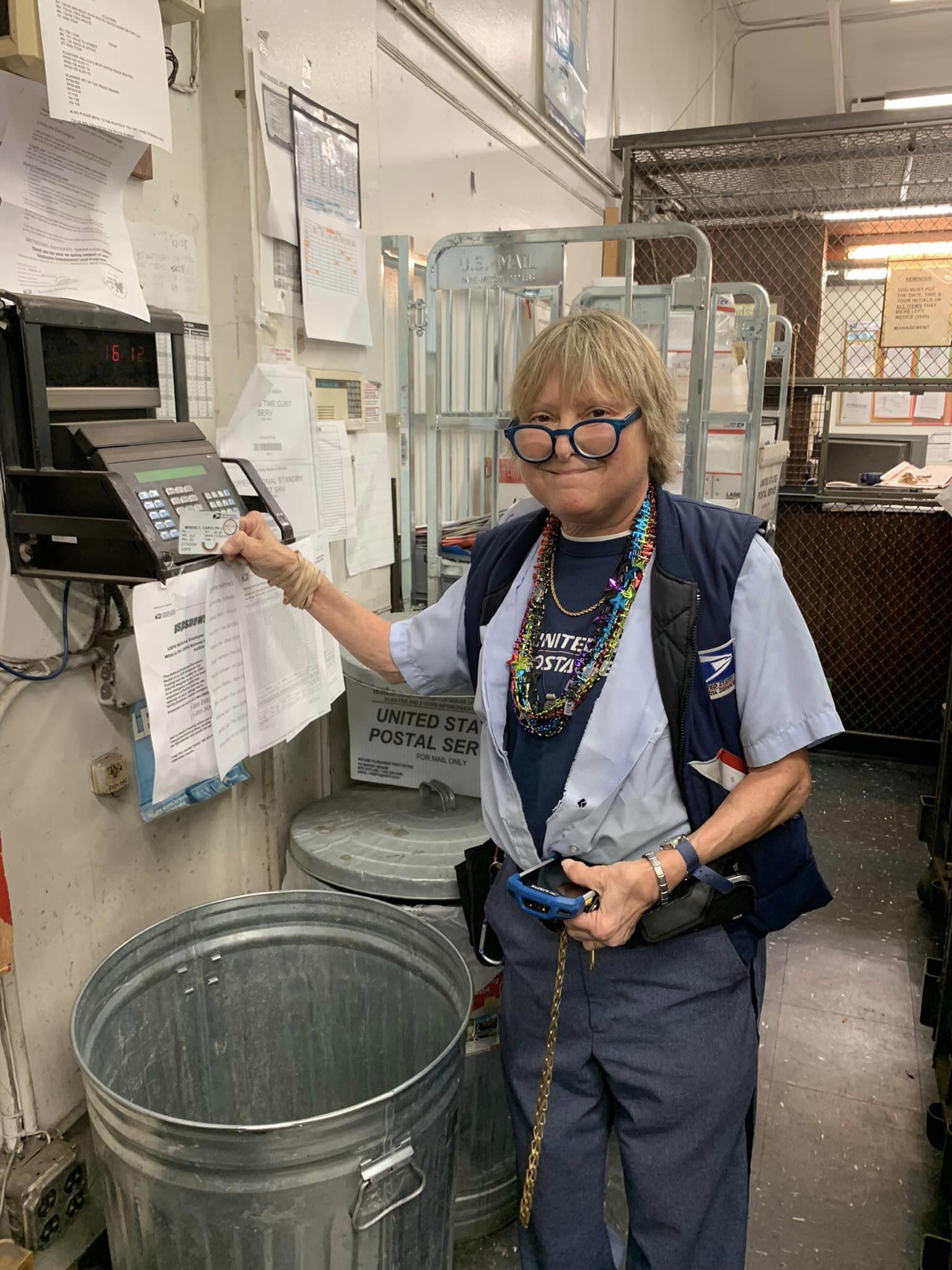

2023 NALC 294 Retirement Bunch

On October 22nd we honored our Union Brothers and Sisters that are now retired with our annual brunch at the Douglaston Manor. We also welcome to the alumni those that have retired over this passed year as well. We give a special thanks to the Honorable NALC President Brian Renfroe

for attended the event for those that retired. We hope that everyone enjoyed the celebration.

Director of Retirees - Clara Sarmiento

Seek Help From Our Branch

As we make plans there are some things that may come to mind like do I have enough time to retire, will I be financially secure and how do I get started? Clara has helped many of us through this process to achieved our goal. Our Branch Members can reach her at our NALC Br. 294 office at:

(718) 264-8494 or (718) 264-8495 Fax (718) 294 8498